s417.online

Market

Downgrade Delta Skymiles Card

![]()

The American Express Platinum Delta SkyMiles credit card is like a special card for travelers. Can I downgrade Amex Platinum Delta Skymiles. For full details on Downgrade and Denied Boarding Prioritization MQDs earned from MQD HeadStart using an eligible Delta SkyMiles® American Express Card. downgrade to the American Express® Gold Card or the American Express® Green Card. Delta SkyMiles® Reserve American Express Card. LEARN MORE · User Avatar see. Official card of life's best moments. Hawaiian Airlines® World Elite MasterCard®. SkyMiles® Members can also enjoy greater flexibility and peace of mind when traveling on an Award Ticket with the ability to change their plans at any time. The. The Delta SkyMiles American Express Card just got an update. Upgrade to the metal Delta SkyMiles® Reserve Business American Express Card · Elevate Your Status · Reach Medallion Status, faster, with Status Boost · Get closer. For a few years I've gotten garbage email telling me I should go to their skymiles club and I never did. Yesterday jfk was empty when we got there so we were. The American Express Platinum Delta SkyMiles credit card is like a special card for travelers. Can I downgrade Amex Platinum Delta Skymiles. The American Express Platinum Delta SkyMiles credit card is like a special card for travelers. Can I downgrade Amex Platinum Delta Skymiles. For full details on Downgrade and Denied Boarding Prioritization MQDs earned from MQD HeadStart using an eligible Delta SkyMiles® American Express Card. downgrade to the American Express® Gold Card or the American Express® Green Card. Delta SkyMiles® Reserve American Express Card. LEARN MORE · User Avatar see. Official card of life's best moments. Hawaiian Airlines® World Elite MasterCard®. SkyMiles® Members can also enjoy greater flexibility and peace of mind when traveling on an Award Ticket with the ability to change their plans at any time. The. The Delta SkyMiles American Express Card just got an update. Upgrade to the metal Delta SkyMiles® Reserve Business American Express Card · Elevate Your Status · Reach Medallion Status, faster, with Status Boost · Get closer. For a few years I've gotten garbage email telling me I should go to their skymiles club and I never did. Yesterday jfk was empty when we got there so we were. The American Express Platinum Delta SkyMiles credit card is like a special card for travelers. Can I downgrade Amex Platinum Delta Skymiles.

Delta cards can only be changed to Delta, and not Hilton or the EveryDay card. American Express credit cards with downgrade paths: Amex EveryDay Preferred. Note that you can't get this welcome offer if upgrading or downgrading from other SkyMiles Amex cards. If you're looking to upgrade or downgrade, you should. SkyMiles Credit Cards · SkyMiles Airline Partners · SkyMiles Program Overview Involuntary downgrading in a lower class; Delay/damage/destruction/loss of. 15X Points Offer, Cruise Criminals, Free SkyMiles for Washington State, Delta's “Big” Announcement and more News! United Chase Credit Card Bonuses: “Seems. This is a new way to get closer to Medallion Status by earning MQDs when you make everyday purchases on your eligible Delta SkyMiles American Express Card. The entry level no-annual fee Delta Amex card offers 2X Delta SkyMiles on Delta purchases as well as at restaurants worldwide. Beginning February 1, , Delta SkyMiles® Platinum, Platinum Business, Reserve and Reserve Business American Express Card Members will receive an MQD. Request a refund if your flight was canceled or significantly delayed (> minutes), or if you experienced a downgrade in your class of service. so you can downgrade the card down to the gold card. or the green card, but there's Finally, I get an AMEX Platinum card, I come to the Delta terminal. For example, the Delta SkyMiles® Gold American Express Card can be product changed to any Amex Delta card. American Express often gives you promotions to. Citi® / AAdvantage® Platinum Select® MasterCard® · United MileagePlus® Explorer Card · Gold Delta SkyMiles® Credit Card from American Express. When Delta Airlines made sweeping changes to its loyalty program in September , cutting Sky Club lounge access benefits from American Express cards, the. Buy or Transfer Miles · Travel with Miles · SkyMiles Partners & Offers · SkyMiles Award Deals · SkyMiles Credit Cards downgrade in your class of service. You. Numbers 1 & 2 are obvious options, but I bet most of you reading this didn't know that downgrading your credit card was an option. Downgrading a credit card is. Effective February 1, Basic Delta SkyMiles Platinum and Platinum Business American Express Card Members (each, an “Eligible Card”), will receive two. Delta cards is your oldest credit card and want to downgrade to a no annual fee card to keep your credit score intact. But other than that, 99% of people. Citi® / AAdvantage® Platinum Select® MasterCard® · United MileagePlus® Explorer Card · Gold Delta SkyMiles® Credit Card from American Express. While you can only use Delta SkyMiles with Delta or one of its SkyTeam partner airlines, you can transfer Membership Rewards to a number of Amex transfer. Beginning February 1, , Delta SkyMiles® Platinum, Platinum Business, Reserve and Reserve Business American Express Card Members will receive an MQD.

What Impacts Mortgage Interest Rates

Should You Be Concerned? If you're in a fixed-rate mortgage, changes in the fed fund rate won't impact you much. However, if you have an ARM or HELOC loan, your. When interest rates are high, it's more expensive to borrow money; when interest rates are low, it's less expensive to borrow money. Before you agree to a loan. A higher credit score may help you get better mortgage rates. Learn more at Better Money Habits about mortgage rates and what credit score you need for a. Rising inflation shrinks purchasing power as prices of goods and services increase. Higher prices can then influence the Federal Reserve's interest rate policy. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Your credit score plays a big role in your mortgage rate. The higher your score, the lower your rate — and the more money you stand to save. The interest rate for different types of loans depends on the credit risk, timing, tax considerations, and convertibility of the particular loan. Lenders and. Your credit score, down payment and loan term are key ingredients that help determine your mortgage rate — but you're not the only cook in that kitchen. 12 Variables That Affect Your Mortgage Interest Rate · 1. Property Use. Primary residences typically have the lowest interest rates when compared to second. Should You Be Concerned? If you're in a fixed-rate mortgage, changes in the fed fund rate won't impact you much. However, if you have an ARM or HELOC loan, your. When interest rates are high, it's more expensive to borrow money; when interest rates are low, it's less expensive to borrow money. Before you agree to a loan. A higher credit score may help you get better mortgage rates. Learn more at Better Money Habits about mortgage rates and what credit score you need for a. Rising inflation shrinks purchasing power as prices of goods and services increase. Higher prices can then influence the Federal Reserve's interest rate policy. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Your credit score plays a big role in your mortgage rate. The higher your score, the lower your rate — and the more money you stand to save. The interest rate for different types of loans depends on the credit risk, timing, tax considerations, and convertibility of the particular loan. Lenders and. Your credit score, down payment and loan term are key ingredients that help determine your mortgage rate — but you're not the only cook in that kitchen. 12 Variables That Affect Your Mortgage Interest Rate · 1. Property Use. Primary residences typically have the lowest interest rates when compared to second.

The Federal Reserve does not set mortgage rates, these rates are set by individual lenders. However, the Fed does set the federal funds rate, which affects. When the central bank raises the federal funds target rate, as it did throughout and , that has a knock-on effect by causing short-term interest rates. Prepayment risk is higher than in recent decades largely because of uncertainty around future interest rates. Both factors are likely to continue to push up. The lending industry carves up the credit score scale into point increments and adjusts the rates it offers borrowers each time a credit score moves up or. So, a mortgage provider has to pay a higher interest rate to get investors to lend to it. And when the economy is weak, the reverse is true. The global economy. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Mortgage rates can be influenced by a combination of factors, including the overall health of the U.S. economy, inflation rates, and decisions made by the. Explore the different factors that influence your mortgage rate. · Your mortgage type. The type of mortgage you select will influence the mortgage rate you. When there are plenty of mortgage bonds on the market, demand is lower and interest rates will be lower. And if demand increases and there are fewer mortgage. Credit Score: While there are many external factors that affect your mortgage rate, your rate is also determined, in part by your own individual financial. What Affects Mortgage Rates? A complex set of factors impact mortgage interest rates, including broader economic conditions, the monetary actions of the. Monetary Policy Impacts Mortgage Rates The actions of the Federal Reserve can influence demand for credit and shape the country's interest rates, including. Generally, bad news and uncertainty in the world are good for mortgage interest rates. Investors tend to flock to bonds in bad times because bonds are safe. When inflation causes central banks to raise interest rates, borrowing becomes more expensive, leading to higher costs for new mortgages. As a result, if you're. When the Fed adjusts its benchmark interest rate, it indirectly influences how much banks charge each other for short-term loans, affecting long-term mortgage. How Much Can A 1% Difference in Your Mortgage Rate Save Or Cost You? On a $, house with a 20% down payment and a year fixed-rate mortgage rate at 3%. To grasp the importance of mortgage rates, let's start by clarifying what they are. Mortgage rates refer to the current interest rates that lenders offer on. As of , the average mortgage loan interest rate is around %. a couple of men sitting on a couch with a calculator discussing interest rates. How Does. Factors that affect mortgage rates Your mortgage rate is a unique number affected by your personal financial situation as well as larger economic factors. You might not think that a slight increase or decrease in interest rates will make much of an impact — until you consider the long-term effect. For example, if.

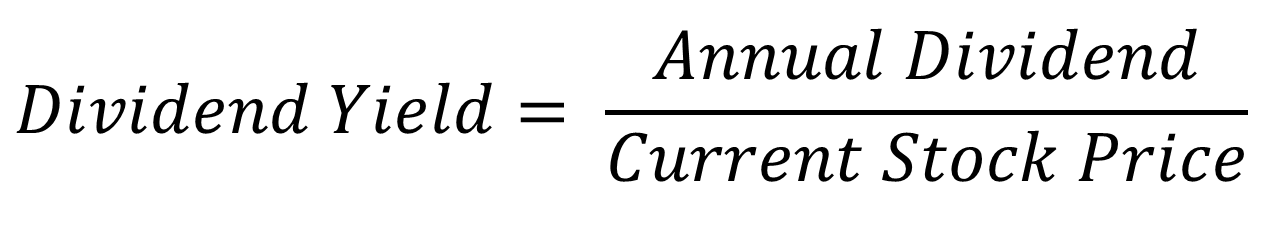

What Is Div Yield

The dividend yield or dividend–price ratio of a share is the dividend per share divided by the price per share. It is also a company's total annual dividend. Yields in parentheses are forward yields based on expected future dividends as stated by the company. Special Dividends - Select the 'Include Special Dividends'. The Dividend Yield is a financial ratio that measures the annual value of dividends received relative to the market value per share of a security. Dividend Yield: This is a ratio that shows how much a company pays out in dividends each year relative to its stock price. · Dividend Payout Ratio: The payout. A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the. Investors often face a choice between Dividend Growth stocks and High Yield stocks when seeking income-generating investments. While High Yield stocks offer. Dividend yield formula Most companies pay quarterly dividends. For such companies, the annualized dividend per share = 4 x quarterly dividend per share. How. Dividends represent a payment by a company, typically made on a quarterly basis, to its shareholders from income generated by the business. “Generally, it's. The dividend yield shows the percentage of a stock's price paid out as dividends each year. Mature companies, like those in utilities and consumer staples. The dividend yield or dividend–price ratio of a share is the dividend per share divided by the price per share. It is also a company's total annual dividend. Yields in parentheses are forward yields based on expected future dividends as stated by the company. Special Dividends - Select the 'Include Special Dividends'. The Dividend Yield is a financial ratio that measures the annual value of dividends received relative to the market value per share of a security. Dividend Yield: This is a ratio that shows how much a company pays out in dividends each year relative to its stock price. · Dividend Payout Ratio: The payout. A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the. Investors often face a choice between Dividend Growth stocks and High Yield stocks when seeking income-generating investments. While High Yield stocks offer. Dividend yield formula Most companies pay quarterly dividends. For such companies, the annualized dividend per share = 4 x quarterly dividend per share. How. Dividends represent a payment by a company, typically made on a quarterly basis, to its shareholders from income generated by the business. “Generally, it's. The dividend yield shows the percentage of a stock's price paid out as dividends each year. Mature companies, like those in utilities and consumer staples.

Dividends, Dates & Terminology: Things to Know · Dividend Yield. This is the percentage of return a company pays out annually in dividends relative to its share. We present a dividend yield comparison by sectors and individual companies compared to the average dividend yield of their respective market segment. The level of dividend undergoes periodic review by the company's Board of Directors and is subject to change at any time depending on a variety of factors. Ex-Dividend Date 08/26/ · Dividend Yield % · Annual Dividend $ · P/E Ratio N/A. You can think of the dividend yield as the percent return that an investor would expect to earn on their investment based on the current share price. 12/26/, 01/10/ Historical Dividends (NYSE: MO). Description: Common Stock. Current Dividend Yield (%): Current Year - Announce Date, Ex-. The following table lists the top exchange-traded funds with the highest dividend yields. The dividend yield is calculated by dividing the most recent. Generally investors use something known as a 'trailing dividend yield'. This tells you the total value of all the dividends paid out over the prior year as a. Dividend Yield Mutual Funds - Dividend Yield is the dividend paid per unit divided by the market price. These are equity funds which invest in equity and. The MSCI World High Dividend Yield Index is based on the MSCI World Index, its parent index, and includes large and mid cap stocks. This ratio lets you know the amount of dividends you could expect to receive each year for every dollar invested in a stock. The formula for calculating the. Dividend yield (projected) for a stock is the percentage of its stock price that a company is projected to pay out as dividends. It is calculated by dividing. 2. What is meant by a dividend yield? To determine the dividend yield, the dividend to be paid by a company is divided by the share price. To give an example. The S&P Dividend Yield represents the average dividend return from the companies within the Standard & Poor's Index, which includes leading. For example, you own a stock that pays % dividends per share. The stock price is Rs Thus, you will receive Rs (%*50) dividend per share. Assuming. The S&P Dividend Yield, as calculated by the S&P Dividends Per share TTM divided by the S&P close price for the month, reflects the dividend. A dividend is an amount of money paid regularly by a company to its shareholders. Dividend stocks are popular among investors because they are typically well-. Dividends represent a payment by a company, typically made on a quarterly basis, to its shareholders from income generated by the business. “Generally, it's. Wellington Management began by dividing dividend-paying stocks into quintiles by their level of dividend payouts. The first quintile (i.e., top 20%) consisted. High Dividend Yield Index Fund seeks to track the performance of a benchmark index that measures the investment return of common stocks.

How To Save Money Tax Free

It's a simple, tax-effective way to dedicate money to charitable giving: you make a donation of cash or other assets, become eligible to take a tax deduction. Using tax-deferred accounts when appropriate can help keep more of your money invested and working for you—and you then pay taxes on withdrawals in the future. From maximizing tax-advantaged savings accounts to donating to charity, here are tax-planning strategies to consider before year-end. After all, when you get a tax refund, it's as if you'd made an interest-free loan to the government. Set up direct deposit to put the extra money directly into. Learn basic tax-saving strategies you should know to help reduce your taxes. · Step 1: Earn Tax-Free Income · Step 2: Take Advantage of Tax Credits · Step 3: Defer. If your adjusted gross income is $36, or less ($73, or less if married filing jointly), you could receive a tax credit up to $1, ($2, if married. Otherwise Roth IRA/k/b/b, HSA or are the only investment accounts where you can avoid paying taxes on earnings. Upvote. Estimating taxes in retirement · You can arrange for income tax to come off at source from your company pension, CPP and OAS. · You can pay tax on income from. An ISA is a 'wrapper' that shelters your investments or savings from tax – helping your money grow more quickly. The government sets a maximum amount that you. It's a simple, tax-effective way to dedicate money to charitable giving: you make a donation of cash or other assets, become eligible to take a tax deduction. Using tax-deferred accounts when appropriate can help keep more of your money invested and working for you—and you then pay taxes on withdrawals in the future. From maximizing tax-advantaged savings accounts to donating to charity, here are tax-planning strategies to consider before year-end. After all, when you get a tax refund, it's as if you'd made an interest-free loan to the government. Set up direct deposit to put the extra money directly into. Learn basic tax-saving strategies you should know to help reduce your taxes. · Step 1: Earn Tax-Free Income · Step 2: Take Advantage of Tax Credits · Step 3: Defer. If your adjusted gross income is $36, or less ($73, or less if married filing jointly), you could receive a tax credit up to $1, ($2, if married. Otherwise Roth IRA/k/b/b, HSA or are the only investment accounts where you can avoid paying taxes on earnings. Upvote. Estimating taxes in retirement · You can arrange for income tax to come off at source from your company pension, CPP and OAS. · You can pay tax on income from. An ISA is a 'wrapper' that shelters your investments or savings from tax – helping your money grow more quickly. The government sets a maximum amount that you.

Designed to help you save money for a wide range of goals — not just retirement. You get competitive interest rates and there is no need to keep a minimum. An ISA is a 'wrapper' that shelters your investments or savings from tax – helping your money grow more quickly. The government sets a maximum amount that you. First-Time Homebuyers Savings Account. Related Topics: Tax Credits, Deductions & Exemptions Guidance. Individual Income Tax. Depending on your income, you may be able to deduct any IRA contributions on your tax return. Like a (k) or (b), monies in IRAs will grow tax deferred—and. 6 Strategies to Lower Your Tax Bill · 1. Invest in Municipal Bonds · 2. Shoot for Long-Term Capital Gains · 3. Start a Business · 4. Max Out Retirement Accounts and. You can buy savings bonds in increments of $ You buy them at face value, meaning if you pay $50 using your refund, you get a $50 savings bond. Tax-deferred accounts let you invest after-tax dollars to save for retirement. Any interest you earn in the account grows tax-free until you retire. Then, you'. You need earned income to contribute to a Registered Retirement Savings Plan but not to a Tax-Free Savings Account. The earnings on deposits on either plan grow. Save for education, save on your taxes tax benefits help your savings grow faster. Tax-free earnings, favorable gift tax treatment and additional state. An HSA is a tax-exempt account that belongs to you. The funds may be used to pay for your plan deductible and/or other qualified medical expenses that do not. AIM ISAs. AIM ISAs hold shares in companies from the Alternative Investment Market and as you would expect with an ISA, any growth and income are tax free. If your deductible expenses and losses are more than the standard deduction, you can save money by deducting them one-by-one from your income (itemizing). Tax. For most people a high interest savings account or a term deposit within a Tax Free Savings Account works just fine. These options are safe and sure—you know. You can even hire your children to shelter your income from taxes. Income paid to your children has a lower marginal rate; sometimes, the tax is eliminated. You can save on sales taxes by avoiding shopping for all but food. Otherwise, taxes are based on income and value of your property. Create a. Ways to save money with year-end tax tips · 1. Get your credits and deductions. · 2. Give to charities. · 3. Pay medical expenses. · 4. Get set for tax-free savings. The Comptroller encourages all taxpayers to support Texas businesses while saving money on tax-free purchases of most clothing, footwear, school supplies. Save for education, save on your taxes tax benefits help your savings grow faster. Tax-free earnings, favorable gift tax treatment and additional state. Members now have another way to save money, with the new Tax-Free Savings Account (TFSA). You can save or invest money without paying tax on the income it earns. If you're saving for your child, chances are you're putting money away for their education expenses. Here's the good news. When you invest in certain.

Top Rated Homeowners And Auto Insurance Companies

1. State Farm · 2. Allstate · 3. Nationwide · 4. Travelers · 5. Universal Property and Casualty Insurance · 6. Amica Mutual · 7. Geico · 8. Erie. Homeowners Policy Comparison ; Foremost Insurance Company Grand Rapids, Michigan ; Dwelling Fire Three Policy Owner Occupied (PDF) ; Tenant Insurance Policy (PDF). State Farm has the best homeowners insurance in New York in Nationwide and Travelers also get 5-star ratings in our analysis of availability, rates and. Looking to compare insurance quotes? Talk to one of our agents to find out why Goosehead is one of the best insurance comparison sites out there! For insurance, USAA. USAA auto insurance is consistently rated among the best in the United States in both price and service. [1]. NFCU actually. Most insurers will pay out the specified amount for up to one year from the date of the accident. Voluntary property damage: Voluntary property damage coverage. The NFIP underwrites most flood policies in the U.S.; you can buy that coverage through most insurance agencies that sell homeowners and car insurance. The. Which homeowners insurance company has the highest customer satisfaction? · Amica: Known for its high customer ratings and comprehensive coverage. · State Farm. Amica is the best homeowners insurance company in Ohio, based on our analysis, with a score of out of 5. 1. State Farm · 2. Allstate · 3. Nationwide · 4. Travelers · 5. Universal Property and Casualty Insurance · 6. Amica Mutual · 7. Geico · 8. Erie. Homeowners Policy Comparison ; Foremost Insurance Company Grand Rapids, Michigan ; Dwelling Fire Three Policy Owner Occupied (PDF) ; Tenant Insurance Policy (PDF). State Farm has the best homeowners insurance in New York in Nationwide and Travelers also get 5-star ratings in our analysis of availability, rates and. Looking to compare insurance quotes? Talk to one of our agents to find out why Goosehead is one of the best insurance comparison sites out there! For insurance, USAA. USAA auto insurance is consistently rated among the best in the United States in both price and service. [1]. NFCU actually. Most insurers will pay out the specified amount for up to one year from the date of the accident. Voluntary property damage: Voluntary property damage coverage. The NFIP underwrites most flood policies in the U.S.; you can buy that coverage through most insurance agencies that sell homeowners and car insurance. The. Which homeowners insurance company has the highest customer satisfaction? · Amica: Known for its high customer ratings and comprehensive coverage. · State Farm. Amica is the best homeowners insurance company in Ohio, based on our analysis, with a score of out of 5.

Save an average of $ by bundling home and auto insurance with SelectQuote. SelectQuote shops top insurance companies to find the best home and auto. Great rates and expert advice on home insurance. Get a free online quote 1 for coverage to protect you, your property, and your belongings from the unexpected. Auto-Owners Insurance is among the top insurance providers in the U.S., offering a wide variety of discounts and coverages to meet your needs. New York Homeowners Insurance Rates. Fill out 1 Simple Form and Get The Best Quotes within Minutes. 10 Free Quotes from Top-Rated Insurance Companies. Average homeowners insurance costs in New York from the Best Rated Home Insurance Companies in New York State. Metlife, Travelers, Progressive, Farmers. AM Best is the largest credit rating agency in the world specializing in the insurance industry. AM Best does business in over countries. The Hartford has consistently been one of the highest rated insurance companies in the industry, offering customers a wide range of coverage options. Compare home insurance quotes from Progressive, Allstate, Liberty Mutual and Nationwide (+ other top companies) with The Zebra. Insurance for car, home, tenant and condo in Canada. Sonnet Insurance is a top-rated insurance company you can trust. Get your online quote in just minutes. Bundle up: Insuring multiple assets with one company, known as bundling, is a common way to get a discount. Combining property and auto insurance is the most. State Farm offers the best home and auto insurance bundle, with an average annual rate of $2, It earns the top spot thanks to its sizable discount. We're giving you the five best insurance companies in the state of Texas, from the stable giants, to the new web chat based insurance companies that can give. State Farm, Allstate, and Nationwide are the best insurers for home and auto insurance bundling. As Insurify's home and pet insurance editor, Danny also. Some insurance providers offer discounts to older homeowners. The PC® auto insurance and home insurance are arranged for by PC Financial Insurance Broker Inc. At Allstate, we tailor each policy to each homeowner's insurance needs. Our agents will work with you to make sure you get the best protection for you and your. The Colorado Division of Insurance has created this report, to provide consumers an opportunity to compare auto insurance premium rates in Colorado. Kin Insurance offers easy, affordable homeowners insurance designed for your needs. Call today at or get an online quote now! Get an insurance quote in minutes from a top-rated company. Find 24 Simply quote auto and homeowners insurance and you could earn a multi-policy discount. They offer various discounts, including for bundling home and auto insurance. Allstate. Allstate is known for its extended coverage options and numerous. Intact Insurance for your car, home and business insurance needs. Get the best protection for you and your family and get a quote today.

Money Market Meaning

:max_bytes(150000):strip_icc()/Moneymarket1-9772966adfb74ce696740d53542e6c13.jpg)

Money market funds invest in high quality, short-term debt securities and pay dividends that generally reflect short-term interest rates. Many investors use. With interest rates at a more than year high, some money market funds offer yields of around 5%. Before you invest, let's break down what you need to know to. Money market funds are a type of mutual fund that invests in high-quality, short-term debt instruments and cash equivalents. This market involves companies issuing bonds and stocks to raise money to grow their businesses. Investors buy these stocks to share in the company's growth and. The money market refers to trading in very short-term debt investments. It involves continuous large-volume trades between institutions and traders at the. A money market account is a unique savings account that generally earns you a higher savings rate than traditional savings accounts. The money market is an organized exchange market where participants can lend and borrow short-term, high-quality debt securities. A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk, stability of. A money market fund (MMF) is a type of mutual fund that invests in cash, cash equivalents and short-term debt securities. Think of MMFs as a cash management. Money market funds invest in high quality, short-term debt securities and pay dividends that generally reflect short-term interest rates. Many investors use. With interest rates at a more than year high, some money market funds offer yields of around 5%. Before you invest, let's break down what you need to know to. Money market funds are a type of mutual fund that invests in high-quality, short-term debt instruments and cash equivalents. This market involves companies issuing bonds and stocks to raise money to grow their businesses. Investors buy these stocks to share in the company's growth and. The money market refers to trading in very short-term debt investments. It involves continuous large-volume trades between institutions and traders at the. A money market account is a unique savings account that generally earns you a higher savings rate than traditional savings accounts. The money market is an organized exchange market where participants can lend and borrow short-term, high-quality debt securities. A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk, stability of. A money market fund (MMF) is a type of mutual fund that invests in cash, cash equivalents and short-term debt securities. Think of MMFs as a cash management.

Money market funds that primarily invest in corporate debt securities are referred to as prime funds. In response to the financial crisis, the. Money market funds are a type of mutual fund developed in the s as an option for investors to purchase a pool of securities that generally provided higher. Money market accounts – commonly referred to as MMAs – come with insurance. It means that if the financial institution utilized goes bankrupt or completely. Money market basically refers to a section of the financial market where financial instruments with high liquidity and short-term maturities are traded. It is. A money market fund is a type of mutual fund that invests in high-quality, short-term debt instruments and cash equivalents. Money market funds are a type of mutual fund that invests in low-risk, short-term debt securities, such as Treasury bills, municipal debt, or corporate bonds. Banker's Acceptance, Treasury Bills, Repurchase Agreements, Certificate of Deposits, and Commercial Papers are a few of the popular money market instruments. The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year. Money Market · Suggested Videos. Classification of business · 1] Treasury Bills. These are money market instruments issued by the Reserve bank of India (RBI). A money market fund is an open-ended fund that invests in short-term fixed-income securities such as US Treasury bills and commercial papers. Money market funds. Money market accounts are a type of deposit account that earns interest. Rates are often higher than traditional savings accounts. Money market accounts. Money market consists of various financial institutions and dealers, who seek to borrow or loan securities. It is the best source to invest in liquid assets. Financial Markets include any place or system that provides buyers and sellers the means to trade financial instruments, including bonds, equities. A money market account (MMA) or money market deposit account (MMDA) is a deposit account that pays interest based on current interest rates in the money. Money market securities are essentially IOUs issued by governments, financial institutions, and large corporations. These instruments are very liquid and. The money market operates through the interaction of various participants, including governments, corporations, financial institutions, and individual investors. A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk, stability of. Washington, DC; August 22, —Total money market fund assets1 increased by $ billion to $ trillion for the week ended Wednesday, August Financial Markets include any place or system that provides buyers and sellers the means to trade financial instruments, including bonds, equities. Money market instruments are short-term financing instruments which can be converted easily to cash. Interbank loans (loans between banks), money market mutual.